This post may contain affiliate links which means I may receive a commission for purchases made through links. Learn more on my Private Policy page.

Can Computer Replace Humans in the Stock Market?

The world of investing has come a long way since the days when stock markets were the exclusive domain of human traders, shouting and waving their hands on the trading floor. Today, computer algorithms dominate the market, accounting for over 70% of all stock trades. So, can computers replace human beings in the stock market? In this article, we will explore the role of computers and algorithms in the stock market, the advantages they offer, their limitations, and whether there's still a place for humans in the world of investing.

Understanding Computerized Stock Trading

Before delving into the various aspects of computerized trading, it’s first essential to understand how computers influence the stock market. Computerized trading refers to the use of computer software and algorithms to trade stocks, currencies, commodities, and other financial instruments. This practice is also commonly known as algorithmic trading or high-frequency trading (HFT).

Algorithmic Trading

In algorithmic trading, computers are programmed to follow a defined set of rules and instructions for placing trades. These rules may incorporate quantitative variables such as price, volume, or even qualitative factors such as news and sentiment. Upon meeting pre-set criteria, the trading algorithms automatically place a trade order or exit a position. The scale of these trades varies from thousands of micro-orders per second to dozens of orders per day, depending on the trading strategy.

High-Frequency Trading (HFT)

High-frequency trading (HFT) is a specialized form of algorithmic trading where the key attribute is the speed at which the trades are executed. These high-speed trading algorithms are designed to profit from minuscule price differences and time delays between different exchanges, capturing spreads and market inefficiencies that occur in a matter of milliseconds. As most HFT strategies are based on market movements or news, the faster the trade, the higher the chances of reaping profits.

The Advantages of Computerized Stock Trading

Speed and Efficiency

The primary advantage that computer algorithms bring to the stock market is their capacity to trade at lightning-fast speeds. By running thousands of calculations per second, computers are capable of identifying and executing profitable trades before a human trader could even blink. This speed also allows for better execution, enabling computers to execute large trades within fractions of seconds while minimizing market impact.

Accuracy and Precision

Trading algorithms are designed to strictly follow a pre-set list of rules for buying and selling securities. This unwavering adherence to a predetermined strategy eliminates the potential for human judgment bias, improving accuracy and precision in trade execution. As the old saying goes in investing: emotion is the enemy of profits.

Scalability and Diversification

Through the use of computers, it is possible to manage and monitor a vast number of investments across different markets, geographies, and asset classes simultaneously. This ability greatly enhances scalability, ensuring that profitable opportunities are not missed due to limitations in human oversight. Moreover, it enables traders to pursue a more diversified investment strategy, spreading risks across various holdings.

Lower Costs

The cost of implementing a trade has decreased in recent years, primarily due to the widespread use of automated trading systems. This reduction in trading fees means that computers can generate higher net returns on investment. Additionally, computers can ensure efficient capital allocation by monitoring multiple investment opportunities and consistently identifying the most profitable opportunities.

The Limitations of Computerized Stock Trading

Despite their numerous advantages, computers and algorithmic trading still possess limitations in the stock market landscape.

Algorithmic Limitations

No matter how sophisticated a computer algorithm may be, it is crucial to remember that it is only as smart as the human who designed it. Algorithms are bound by the constraints of pre-defined rules and can only execute strategies within those set parameters. As a result, algorithms may miss more intricate and nuanced trading opportunities that a human trader could identify.

Market Manipulation

Some critics argue that high-frequency trading and other forms of algorithmic trading contribute to market manipulation, specifically through the practices of quote stuffing and spoofing. Quote stuffing refers to the rapid submission and cancellation of a large number of orders to flood the exchange with data, causing increased latency for other traders. Spoofing entails placing orders without the intention of executing them to create a false appearance of market activity. Both practices could potentially generate unfair advantages for the manipulators and erode the market's integrity.

Flash Crashes and System Failures

Given the highly interconnected nature of today's market structure, computers can lead to sudden and sharp price changes – a phenomenon known as “flash crashes.” An example of such an event occurred on May 6th, 2010, where the stock market momentarily lost 9% of its value due to cascading sell orders generated by high-frequency trading algorithms gone haywire. Instances like this illustrate the vulnerabilities inherent in overly reliant on computerized trading systems.

Is There Still a Place for Humans in the Stock Market?

Human Expertise and Judgment

Despite the growing dominance of computers and algorithms in the stock market, there remains a crucial role for human expertise and judgment. Human investors possess a unique ability to think critically, understand complex financial concepts, and adapt to ever-evolving market conditions. Moreover, experienced investors can analyze qualitative factors, such as management decisions, political events, and market sentiment, incorporating this analysis into their strategies.

Relationships and Trust

One enduring aspect of the investment industry is the importance of relationships and trust. Successful investing often relies on a deep understanding of a company's business, products, and industry. This understanding often comes from years of interactions, relationships, and industry experience – a skillset that cannot be reduced to a set of algorithmic rules. Additionally, the personal touch provided by humans is often reassuring to clients, fostering trust and building long-term relationships.

Conclusion

While computers and algorithmic trading have undoubtedly revolutionized the world of investing, replacing many of the roles traditionally held by human traders, there remains a critical need for human expertise, judgment, and relationships. Rather than seeing the rise of computers as a threat, human investors are encouraged to view it as an opportunity – embracing the efficiencies and advantages provided by these technological advancements while leveraging their unique skills and experiences.

Hey and Good Evening Mr.Pinoy…Happy Holiday Greetings to you and your Family From New York City…My Son Wanted To know if you can post another video of you wearing the Timberland Boots…he Love these boots…Happy New Year's 2023

Super durable shoes po ang Ganda at kadalasan ito ang suot ng mga kabayan natin.. More shoes collection..

WOW 👌 THOSE ARE ABSOLUTELY GREAT LOOKING BOOTS ..YOU SHOULD DO SOME MORE VIDEOS ON THEM …BY THE WAY HAPPY HOLIDAY GREETINGS TO YOU AND YOUR FAMILY ALL THE WAY FROM NEW YORK CITY …STAY SAFE AND STAY 🙌 BLESSED

Have the best week friends take care 👍👍👍

nice upload, thanks for this entertainment

Wooow!

wow nice shoes po.. ganda!

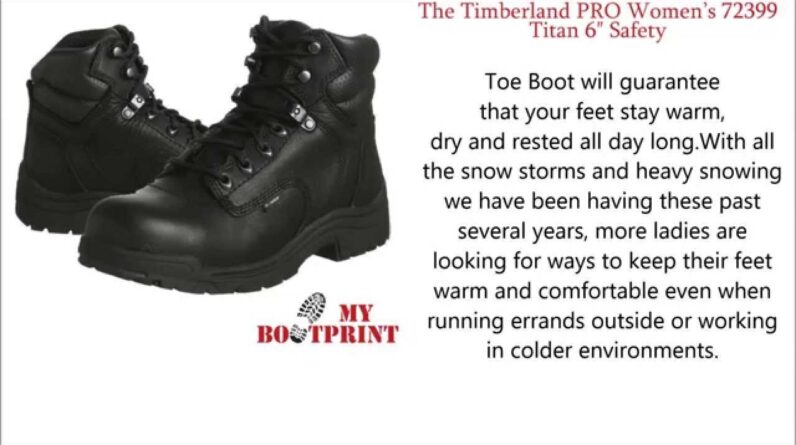

Thiis is actually very good quality shoes, i used to buy this for my husband

مزيد من التالق ونجاح تهانينا القلبيه ❤👍👍

Wow astig ng shoes mo idol!

Solid kabayan💪

Cool boots

Hello, your friend's video is the best. I am moved by sharing a wonderful video. Thank you. Let's do our best together.

Nice protective shoes… That is a good choice… Enjoy wearing it… Watching here🙏🔔✅

Wow nice kaayu ang shoes nami pa ng color

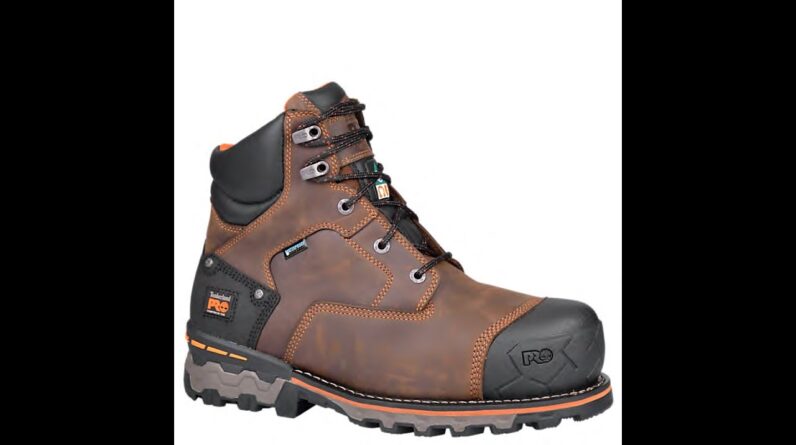

Nice shoes my friend ,the brand is good 😊. Enjoy using new friend here from australia.Im happy to watched your unboxing video 📷

Woww. Great shoes.. Look so strong and stylish

Hello, your video is amazing! Please keep uploading good videos. Good luck!!🌳

likes

Cool Timberland ankle Boots/Shoe.💕

Durable and comfortable shoes, thank you for sharing. Have a blessed day

Excelente vídeo amigo, saludos..

Sa mga hard workers natin mga ofw eto kdlsan nakikita ko..ganitong stelo..water proof pla at suitable for winter ..nice slomo 👍👍

Wow astig at Ang ganda….hindi ba mabigat ilakad hehe… comfy shoes

Watching hère my friend

👍👍wow those are some really durable outdoor walking boots & looks capable of handling any kind of weather 👍👍👏👏👏

Sepatu keren

Wow matibay na brand Idol at mamahaling shoes

thanks for sharing.

Great content friend, thank you